Prepare your Files and you may Remark Your credit report

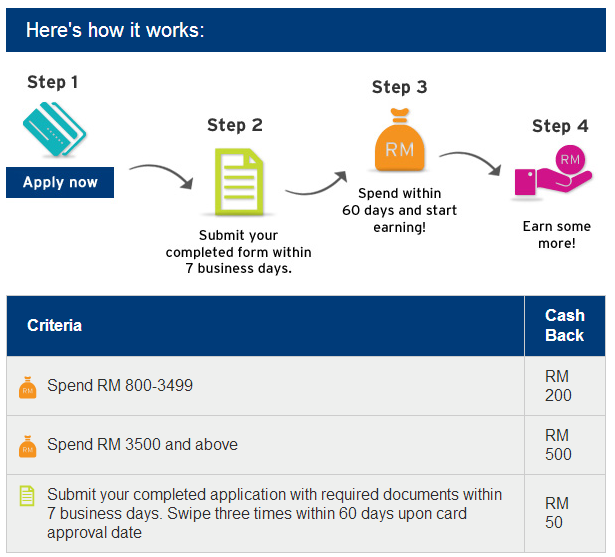

How exactly to Use

The borrowed funds software processes can seem to be overwhelming, but when you understand what to anticipate at each stage away from the method, it can go far smoother. Along with the ability to complete an online software and you can create everything you digitally, they simplifies one thing further. Here is what we offer at each and every action of the financial acceptance procedure.

Get Prequalified

This is the first step the place you bring some initially suggestions to the financial about your house money, debts, and assets and they will make you a projected figure from how much you will be accepted so you’re able to use.

Fundamentally, this requires a softer credit remove to deliver an informal calculation. Whilst you dont get approved on pre-qualification phase alone, you ought to rating pre-accredited one which just fundamentally get approved.

Expect you’ll give plenty of papers (and unlimited even more paperwork) throughout the home loan software processes after which accept a painful pull of the credit history.

Records you will need to assemble are spend stubs or the next-dated employment offer, tax returns, evidence of almost every other types of income (i.e., spousal service), lender comments, money comments, and you may old-age account deals.

The lender may consult that your particular bank account harmony reflect enough exchangeability to pay for people deposit, settlement costs, and extra dollars reserves. (más…)