A branch off Experts Products (VA) cash-aside re-finance lets qualified home owners to carry out good Virtual assistant-recognized financial to displace a preexisting home loan, plus extra bucks. This choice has some unique features and you will pros, in addition to big distinctions from other offered cash-out refinancing actions.

See how Virtual assistant bucks-out re-finance financing try to see if one to would be a good a good refinancing choice for you.

Trick Takeaways

- You are able to a good Va bucks-out refinance to replace whatever mortgage, not just a beneficial Va mortgage.

- In place of most other dollars-aside refinances, so it Va financing enables you to cash-out as much as 100% of your own home’s security.

- An excellent Va cash-away refinance have a very pricey and you can cutting-edge software techniques than just a great Va Interest rate Cures Refinancing Loan (otherwise Va Streamline), and this does not include dollars.

What’s a Va Dollars-Out Re-finance?

An effective Va cash-away re-finance try a way to have residents just who meet with the eligibility standards to change their property loan with a brand new Virtual assistant-recognized loan at the a high amount. The newest mortgage amount enables you to remove a swelling sum of cash. You can use up to 100% of the home’s equity, and utilize the dollars to own whatever you require.

A great Virtual assistant bucks-away refinance was an appealing solution whilst now offers accessibility bucks Banks payday loans no credit check. However, the application form process is much more strict in addition to costs are large than just to the VA’s almost every other big refinancing program, the new Virtual assistant Interest Reduction Refinancing Mortgage (IRRRL).

Also referred to as a great Virtual assistant Streamline, the new Virtual assistant IRRRL is a less complicated, faster techniques than simply a good Va cash-out re-finance, and it also decreases the interest rate on the a preexisting Va mortgage.

That would Make use of a good Va Cash-Away Re-finance?

Typically, refinancing home financing try an easy method toward citizen so you’re able to lower both their attention rates and you can/or their monthly payment. It can also be used to button from 1 type of loan program to another. If you would like a lump sum payment of cash, a finances-out re-finance was an easy way to improve your home loan and you may obtain a little extra money that is rolled toward the new mortgage.

In the course of time, you can easily shell out appeal with this more amount, together with an initial fee, making it important to consider as to why you find attractive bringing an excellent cash-out re-finance. Going on a merchandising spree wouldn’t be wise, however, reasons why you should get a finances-out refinance can sometimes include:

- And also make home improvements

- Financial support children member’s degree

- Settling higher-desire loans otherwise medical expenses

Other variables to consider will be condition of your newest mortgage as well as your brief-identity agreements. If you find yourself over midway via your newest financial, or you intend to relocate the next couple of decades, particularly, then it most likely would not create monetary feel in order to refinance.

Home financing elite which focuses primarily on Va fund can help you crunch the fresh new wide variety to see if an excellent Virtual assistant bucks-aside refinance mortgage is a good complement your position.

The consumer Economic Security Bureau plus the Va urge homeowners to look out for refinancing give cons. Watch out for unwanted now offers that claim to make sure a reduced interest rate, let you disregard mortgage repayments, or make it to the-the-put closings.

Whom Qualifies for a good Va Bucks-Away Re-finance?

You’re going to have to jump courtesy a few hoops in order to meet the requirements to have a Va bucks-aside refinance mortgage. Here are a few of your big qualifications criteria:

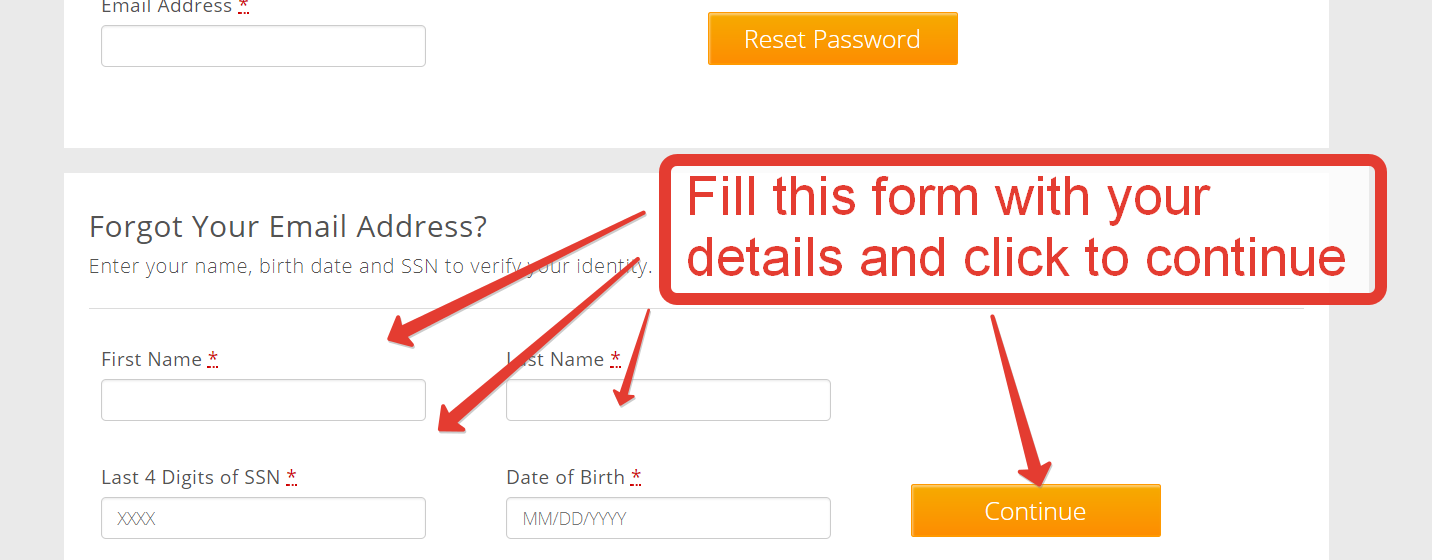

- Certification out-of Qualification (COE): Here is the facts you’ll need to show that you or your wife qualifies to possess an effective Virtual assistant-supported loan. You’ll need to be an experienced, a current solution affiliate, a person in the brand new Federal Protect otherwise Set-aside, otherwise a surviving mate regarding a veteran exactly who died otherwise is handicapped while in the energetic responsibility otherwise provider. Based on the condition, this new papers you will want may include a duplicate of one’s discharge files, a statement out of services finalized by the ruling officer, and/otherwise evidence of honorable provider.