Home ownership was a dream cherished because of the somebody internationally, additionally the Philippines is not any exception. The newest impress of experiencing a place to telephone call your, a sanctuary where you could build treasured memories and you may safer their family’s coming, is actually seriously instilled when you look at the Filipino culture. not, your way so you’re able to homeownership shall be problematic, specially when you are looking at securing the required funds and you can figuring out the way to get pre-acknowledged getting a home loan. This is where mortgage brokers need to be considered, providing a practical solution to change the homeownership ambitions into the a great reality.

The many benefits of Getting your Home

In advance of we explore the brand new the inner workings of your own financial procedure having securing home financing on the Philippines, why don’t we mention the new powerful benefits that are included with homeownership:

Balances and you will Shelter: Getting your residence brings balances and you can a sense of safeguards for you plus members of the family. You aren’t susceptible to local rental grows or the whims of landlords.

Strengthening Security: Since you create mortgage repayments, you are not only investing in a location to real time; you are and strengthening collateral. Over time, your residence becomes an asset.

Capital Possible: Real estate usually values in the worth along the future. Your house could easily make wealth as a consequence of assets appreciate.

Customization: When you own a home, you have the liberty to customize and you can tailor it to complement your likes and requirements in the place of trying to consent regarding a property owner.

Taxation Professionals: In many cases, you happen to be eligible for income tax deductions linked to your mortgage notice, delivering economic recovery.

Misunderstandings In the Home loans

But not, you’ll find well-known misunderstandings from the lenders one deter many of searching for it path so you’re able to homeownership. Why don’t we target any of these home loan myths:

1. Home loans are just into the rich

Believe it or not, mortgage brokers commonly simply for the fresh new rich. All sorts of lenders appeal to additional earnings brackets, and then make homeownership possible for numerous someone.

dos. Higher off repayments is non-negotiable

When you are a downpayment is normally requisite, it’s not usually an insurmountable difficulty. Of numerous lenders render flexible downpayment alternatives, and several authorities programs render assist with earliest-go out homebuyers.

step 3. Loans are difficult so you’re able to safer

Given that mortgage app techniques will be rigid, protecting a mortgage are from impossible. Towards the right preparation and you may guidance, you could boost your possibility of last mortgage recognition too.

4. Lenders online installment loans Illinois is actually a monetary weight

Whenever addressed responsibly, a home loan are going to be a workable investment decision, commonly that have a payment per month much like otherwise less than the cost of renting the same property.

Now that we’ve debunked a few of the prominent misunderstandings surrounding house money, why don’t we talk about the full help guide to protecting a home loan from inside the the fresh new Philippines.

The fresh new Guide to Protecting a home loan regarding the Philippines

Protecting a mortgage about Philippines comes to a number of measures that need mindful believed and you may attention. Listed here is a step-by-action help guide to make it easier to browse the home mortgage processes effortlessly:

1. Assess your financial readiness

Ahead of diving on financial software process, grab a closer look at the financial situation and also the financing imagine. Assess their monthly income, costs, and you will established costs. This can give you a definite understanding of how much cash regarding your own gross month-to-month money you might conveniently allocate to help you mortgage repayments.

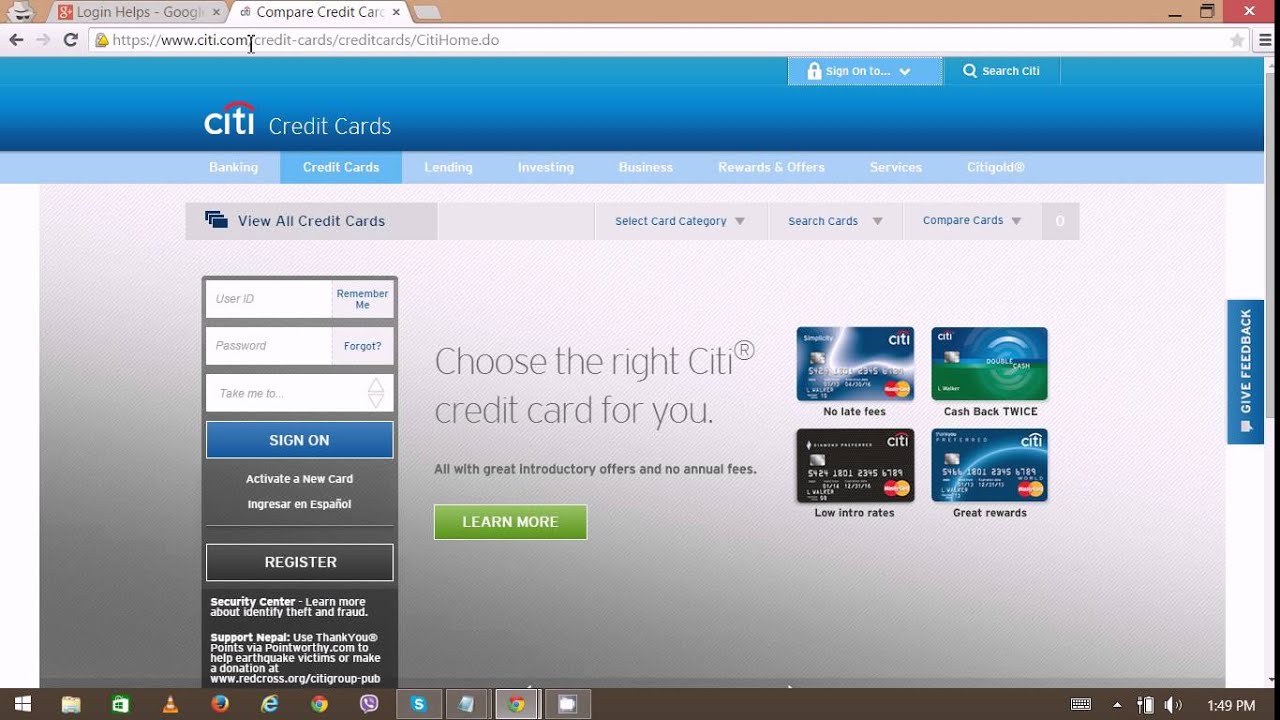

dos. Research loan providers and you will loan selection

Discuss different mortgage lenders here, including banking companies, bodies and you will financial institutions, and private credit businesses. For each can offer certain home loan situations with different conditions, interest rates, and you can eligibility requirements. Seek information to find the one which best suits your needs.