Ceo and Co-Maker out-of Steps Economic, good YC-supported business one connects basic-time homebuyers with downpayment assistance applications over the You. Malcolm-Wiley read business economics at the Harvard and that is an authorized mortgage broker.

If you are planning to acquire property inside Colorado, figuring out just how much you desire for an advance payment try probably your first purchase off team. But, simply how much currency would you like? And while we are at they, what is the mediocre downpayment with the a property in Colorado?

Its a great question to inquire about. If you know just how much anyone normally spend into the a down percentage, you might probably pursue comparable alternatives.

We now have complete brand new math for your requirements, calculating the typical down payment statewide when you look at the Texas, along with averages each big metropolitan urban area.

Disclaimer: This information is to own informational purposes just and should not become regarded as courtroom otherwise monetary recommendations. Delight demand legal counsel, home loan company, otherwise CPA having tips about your unique condition.

According to the Federal Organization off Real estate professionals, the typical down payment to your a home getting first-time homebuyers all over the country is actually 6%. While the the newest average house rate for the Colorado was $301,763*, that metropolitan areas the common deposit towards a house within the Texas from the $18,105 getting basic-day homebuyers.

Keep in mind that 6% is actually the typical. That it commission may vary right up or down dependent on for each and every family buyer’s situation. In addition to, for many individuals, half dozen % isn’t necessarily the optimal total lay out into a primary house.

Three per cent is the minimum deposit getting FHA finance, although some financing items features higher or lower minimums. One of the largest benefits to and come up with a higher down-payment is the rate of interest protection they shopping your. However your interest merely minimizes at 5%, 10%, otherwise 20% down.

Because there isn’t any interest rate drop off to have elevating the downpayment away from 5% to six%, it will be best on your disease and come up with a good 5% deposit and save the excess cash to own unexpected fixes, moving expenses, or even the for example.

Rather, you might bad credit personal loans Nevada be able to use the additional savings to purchase down their interest rate. Their financial professional will help you to discover every selection available to you.

This type of numbers are based on the 6% federal average down-payment getting very first-time customers, along with the newest median household rates for every single certain urban area.

To get a home when you look at the Texas? Find out more

To make a down-payment might be the very first item your tackle in the home to buy process, but it’s not the only one. Check out these types of most other blogs on to shop for a house into the Colorado.

Just how do basic-big date people in the Tx make their off payments?

In the event that such down payment amounts getting a little while intimidating, you are not alone. 26 % from basic-date homebuyers claim that rescuing to own a downpayment try the most challenging element of their property get process.

It might be a challenge, but taking a downpayment to each other is unquestionably you can easily. Here are the typical means basic-big date home buyers make down money.

Experienced fund

Forty-7 percent out of buyers play with personal offers and work out at the very least the its deposit. But loan providers need to make sure the bucks on your bank account originates from yours discounts, unlike another type of, undisclosed origin (such that loan from a different sort of facilities or a present you didn’t mention).

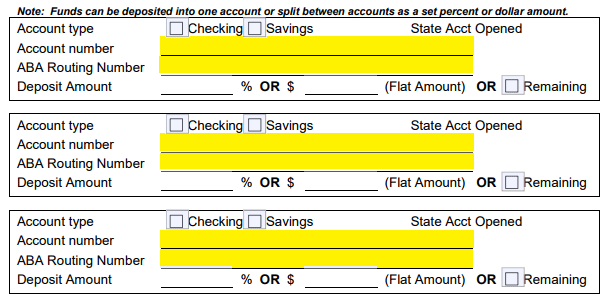

It means most loan providers require you to any personal currency you use for the advance payment could have been seasoned. Put another way, you’ll want to reveal that the money has been in the family savings for a minimum timeframe, always sixty days.

You are obviously allowed to use-money off their supplies, such gift ideas, funds, or any other down payment advice, but you’ll need to tell you proof of the fresh money’s root.

Talented finance

Gift suggestions and you will financing out of loved ones or nearest and dearest are also a common supply of advance payment money to have earliest-go out buyers. Twenty-several % of new people obtain advance payment in that way.

For individuals who wade this station, perform be cautious that there exists statutes in the documenting a gifted down-payment. Including, the person or organization deciding to make the provide should bring records demonstrably showing the money doesn’t need to be distributed straight back.

Advance payment direction (DPA) may not be the most famous supply of advance payment money getting earliest-day homebuyers, nonetheless it more than likely would be.

DPA applications offer significant sums of money to help people build the greatest downpayment you’ll, and some software do not require one pay-off those funds.

Wanting getting deposit advice into the Colorado? There are certain DPA software to own homeowners in the condition.

Benefits of more substantial deposit

However some brand of loans enables you to buy property with little or no money down, there are certain advantages to and come up with good-sized deposit, if you’re able to.

While we mentioned prior to, a larger advance payment can help you get the very best interest rate, particularly if you can easily hit the 5%, 10%, or 20% mark. While doing so, to make a massive deposit function you might not need to use as frequently money, hence increases their purchasing energy and you will lowers your monthly installments.

Obviously, everything is a tradeoff. To find out more, here are some our self-help guide to the pros and you can drawbacks regarding a beneficial highest advance payment.

Most other upfront can cost you to look at

The fresh deposit is considered the most renowned initial bills within the buying a property, however it is not by yourself. There are also closing costs and this have to be repaid within duration of pick.

Closing costs safeguards tertiary expenditures regarding to shop for a home particularly once the financing origination charge, title charges, and you may taxation. Settlement costs usually get wrapped into the home mortgage. Although not, you could love to spend closing costs out of pocket to help you avoid boosting your loan amount.

Settlement costs having people during the Texas mediocre up to 1.5% of the residence’s business rate, although this may vary based your right venue and lots of almost every other circumstances.

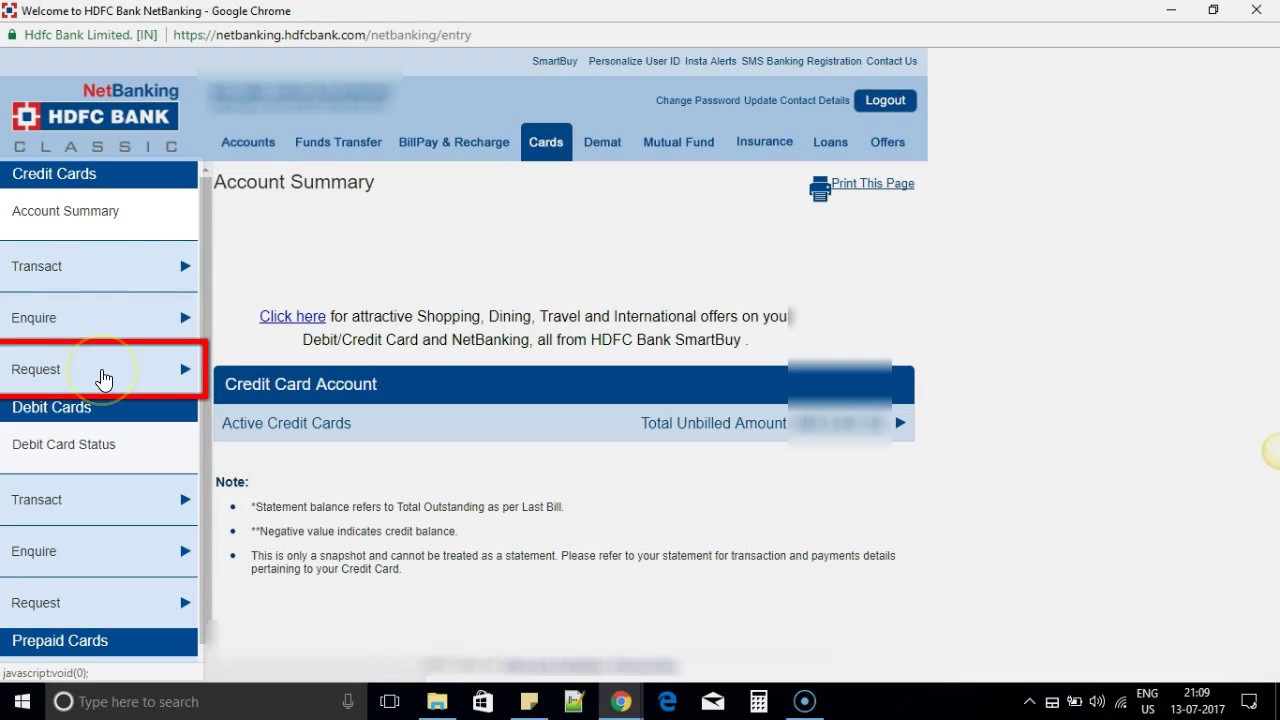

Saving upwards to own an advance payment normally surely performed, but it takes time and energy. Down-payment advice (DPA) can help you result in the largest down payment you are able to which have less months invested reducing expenses and you may saving most of the dime.

DPA programs give thousands or even tens of thousands of dollars to aid homebuyers purchase property having less stress on the money. In addition to this, you can find DPA apps made to match all types of economic situations.

Brand new most difficult part about getting down payment assistance is wanting pointers from the and that apps you qualify for, so you’re able to evaluate your options and make the quintessential told choice.

Stairs connects you having a dependable financial who works together with DPA, next fits your challenging down-payment direction programs you might qualify for – all in one put, in order to evaluate your options oranges-to-apples.