Qualifying ADA members discovered a beneficial 0.25 percent rates prevention so you’re able to DRB’s currently low prices towards lifetime of the loan should they are ADA people. View cost, terms and conditions and you may disclosures at scholar.drbank/ADA.

In the event the earnings by yourself calculated who qualifies to have a home loan, new dental practitioners might possibly be who is fit. Mediocre admission-peak dental practitioners take home around $115,000 per year, making them strong earners on the vision regarding mortgage lenders. Yet not, many dentists scholar off dental care college with a lot of student personal debt, which means he’s got a top debt-to-money ratio (monthly financial obligation in accordance with their month-to-month money) and you may little in the coupons having an advance payment.

Editor’s mention: Here is the fifth blog post inside an autumn financial variety of New Dentist Today blog posts from Darien Rowayton Financial, that gives education loan refinancing and that is supported because of the American Dental Organization

According to the Western Scholar Dental care Connection, 75 % off dental care-school students is actually over $100,000 with debt. Indeed, the common this new dentist happens out-of dental care university over $241,000 regarding the hole, with regards to the American Dental Knowledge Connection. Thereupon much debt, how have you been supposed to persuade a bank in order to provide you currency getting a property?

You are in chance: Many mortgage lenders are willing to undertake this new apparently riskier (exposure as discussed from the a top loans-to-earnings ratio) loans pages out of dentists because of their solid earning potential. It believe you to at your salary and you may occupations stability, possible manage paying down your scholar loans and you can a mortgage.

Home loans that will be designed for dentists mostly end up in an excellent bank’s doctor home loan unit. Of many (although not all the) mortgage brokers offer its ds in order to dental practitioners. You will need to establish that have personal lenders you to dental practitioners are eligible to try to get the doctor mortgages.

Dental practitioner finance require little-to-no money off. It varies from the lender, however the specifications is commonly below ten percent down, with a few lenders enabling dentists to finance 100 percent of your own financing.

Dentist funds don’t need private home loan insurance coverage. Very consumers whom put lower than 20 percent upon its household are required to get personal home loan insurance policies. Despite the low-down-fee needs, of a lot lenders waive private home loan insurance rates to your dental expert loans.

Dentist funds succeed money verification through deal. The average non-dental expert mortgage applicant has to be sure money that have paystubs and you can income tax output. Which have dentist mortgages, many lenders will accept a jobs deal since the proof money.

Dental practitioner loans lookup beyond DTI proportion. Debt-to-money (DTI) ratio, the latest measure of how much out of an enthusiastic applicant’s earnings goes to repaying obligations, try weighted heavily for the fundamental mortgage software. But dental expert, who are generally speaking full of poor DTIs, rating a citation. Definitely for new dentists, of several lenders don’t grounds figuratively speaking from inside the calculating DTI to own dental expert mortgages.

Occasionally, he or she is a benefit so you’re able to dental practitioners that are eager to getting property owners. But not, there’s something to look at before taking out a mortgage designed for dentists:

Some dentist mortgage loans are given from the high interest rates. The latest tradeoff to possess devoid of to get much money to your downpayment can be large interest levels on the dental practitioner mortgage brokers. However, there can be potential to re-finance down the road, paying off home financing on a top interest rate could possibly get high priced. Leasing for a few decades can get succeed some dental practitioners to create up a down payment and finally pick a lower-interest-rate home loan.

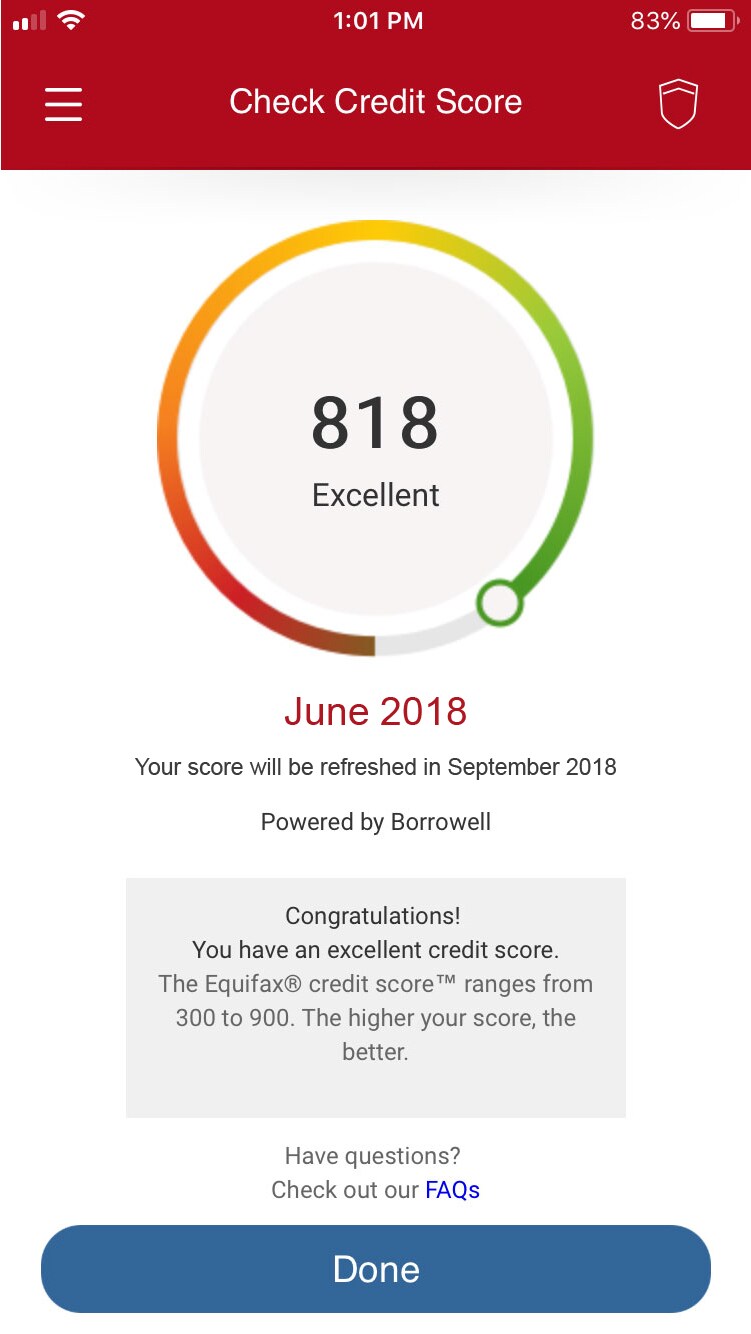

Dental expert fund require high fico scores. Lenders help a great deal go when it comes to approving dentists getting mortgages, but there are many places that it nevertheless draw a difficult line. If you have a credit history below 700, you do not getting an applicant getting a dental expert home loan. You can examine your credit rating free-of-charge contained in this hook.

Dental practitioner financing are varying-speed loans. Fixed-price mortgage loans have a similar interest personal loans Missouri rate for the whole mortgage. Adjustable-price mortgage loans, or Fingers, features a first repaired-speed period ahead of their rates changes. Thus in the event that rates of interest increase if you are off the original repaired period, the monthly installments increase.

Dentist finance, occasionally, enjoys constraints on family method of. Certain dentist fund simply affect particular property products. Such as, certain loan providers won’t grant dental expert mortgages getting sales out of multi-household members house or co-ops. You need to ask that have individual lenders from the whether or not their dental practitioner mortgage loans security the type of home you’re interested in.

Dental expert funds is actually sounding pretty higher, huh?

Particular dental expert funds are not taxation-deductible. This is certainly something different you to definitely varies by the lender, and this will depend on whether or not you itemize or take important deductions, but it is really worth looking at whether a dental expert financial you’re considering was tax-deductible. Don’t neglect to query.

The students come into flux. Even if graduating out-of dental college can feel for instance the opportune time to settle off, delivery the routine every day life is nevertheless a duration of change. Maybe you will have to relocate in a number of many years to own a occupations, or at least you can easily favor a larger household as your money balances or perhaps to complement all your family members needs. Your options may be minimal while dedicated to a home loan that is associated with the brand new decisions you will be making immediately after college or university.

Become a newly minted dentist is actually a captivating, long-anticipated go out that is filled with a great amount of anticipation. A dental expert mortgage is a worthy option in the event the house ownership is a top priority as you go into the next phase of one’s top-notch life.

DRB (Darien Rowayton Financial) are a national bank, marketplace financial therefore the quickest lender within the world records to arrive $1 billion for the student loan refinancings. FDIC covered and you can created in 2006, DRB Student loan have aided thousands of advantages which have scholar and student degree nationwide to re-finance and you will consolidate government and you may personal student education loans, preserving such consumers several thousand dollars for every.

When you find yourself trying to find a dental expert Home mortgage, please find out more here, DRB’s Dental practitioner Real estate loan. DRB are the same Homes Financial.