Debt consolidating

Handling multiple debts are challenging, particularly when for every possesses its own interest rate and you will percentage schedule. Go into the 2nd financial – a proper equipment having consolidating higher-notice expense. This consolidation effort streamlines your debt land toward an individual payment, have a tendency to at the a lesser interest than people individual expense bring.

Debt consolidation reduction because of an extra mortgage just simplifies debt existence in addition to probably preserves cash in the near future of the decreasing the complete notice burden. This approach means abuse, as you is always to end racking up this new loans after you have consolidated the brand new old ones.

Educational expenditures

The expense in the degree would be challenging. A moment mortgage can be funds educational pursuits, especially for moms and dads seeking to assistance their youngsters’ academic journey.

Regardless if you are sending your son or daughter over to university otherwise looking for your own very own advanced training, a moment mortgage offer the monetary backing to fund university fees, books, casing or other expenses. By leveraging the fresh new security of your house, you’re committing to the future when you find yourself potentially capitalizing on straight down rates of interest than the certain kinds of student loans.

Disaster finance

An extra financial can be function as a financial back-up, letting you availableness money fast in times off drama. Regardless if you are facing a medical crisis, unanticipated home repairs or some other unexpected bills, having a way to obtain crisis loans also provide reassurance which help you weather brand new storm as opposed to derailing your financial stability.

2nd mortgage vs. domestic guarantee financing

Whilst the some other terms will be complicated, a second mortgage and you may a property guarantee mortgage is basically the exact same. The second financial are that loan removed following the basic mortgage that makes use of your house as collateral and you will retains another lien standing. Inside sense, a house security mortgage is a kind of 2nd home loan. Domestic equity credit lines also are a form of a beneficial 2nd home loan, nonetheless let the debtor to draw into the financing financing as needed in the place of choosing a lump sum payment.

2nd home loan vs. cash-aside re-finance

Cash-out refinances was a substitute for taking right out a moment financial which could work better for most homeowners. Eg a house equity mortgage, cash-out refinances allow borrower to locate a lump sum out-of money due to their house’s equity. Although not, cash-aside refinances typically let the debtor to consider down attention costs than a moment financial, rather than taking out fully an entirely the new personal line of credit. For almost all consumers, a money-aside re-finance may be the more suitable solution.

Getting an additional mortgage

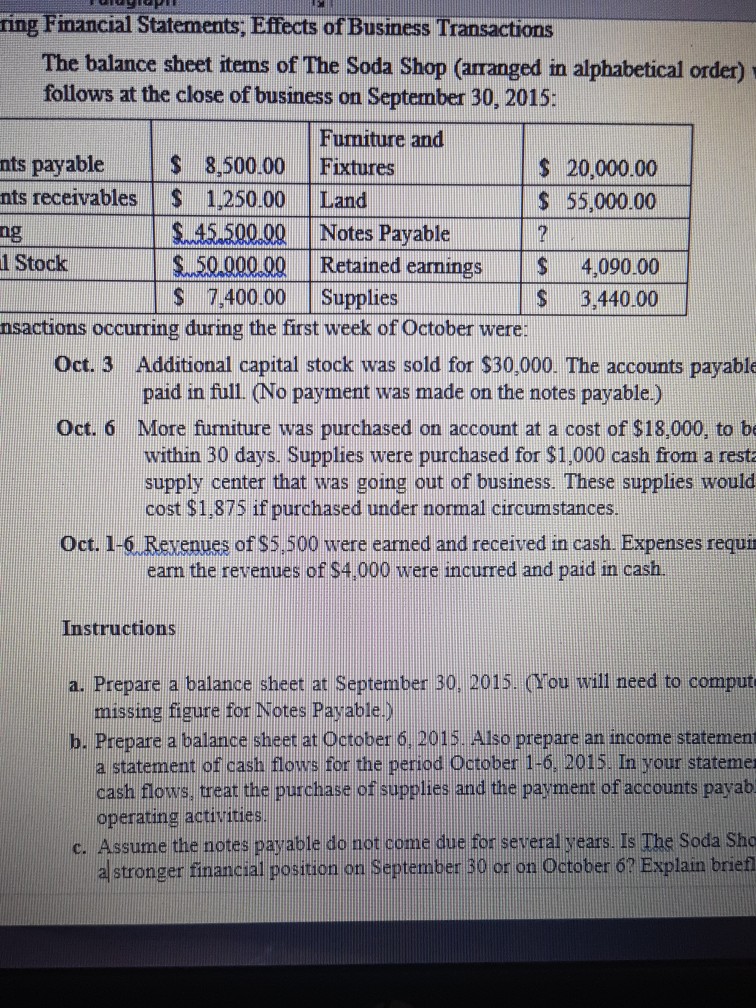

step one. Check the guarantee: Determine the new security available in your house. Very lenders will demand a minimum number of collateral, tend to about to fifteen%, before offered your application.

dos. Check your credit history: Your credit score is crucial inside protecting positive words for the second mortgage. Increased credit rating improves your chances of acceptance that can bring about way more aggressive rates.

step three. Research lenders: Carefully mention various other lenders, evaluating their attention prices, costs and you can terminology. Pick an educated mortgage brokers having a good profile and you can a reputation legitimate support service.

4. Collect papers: Ready yourself called for economic records, instance tax returns, earnings statements and you may information about their property’s worthy of. These types of documents might be pivotal from inside the software techniques.

5. Apply: Fill cash loans in Tildenville in the job towards lender(s) of your preference. Be prepared to provide more information regarding your financial predicament, together with your money, assets and you will bills.

7. Underwriting techniques: Brand new lender’s underwriting people analysis the application, researching your credit report, income plus the property’s really worth. They might demand a lot more paperwork otherwise explanation with this phase.