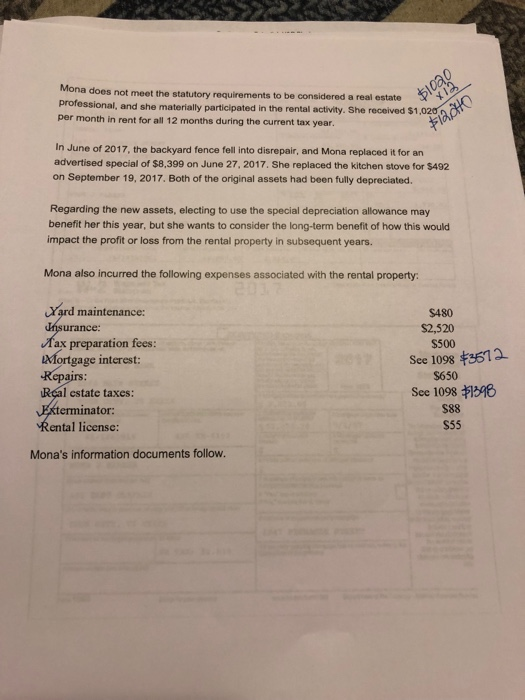

California’s market has long been noted for its high cost and aggressive characteristics. That have property can cost you increasing, homeownership aspirations often feel like they need to be within reach for many, specifically first-go out consumers. But not, Government Casing Government (FHA) financing had been a game-changer lately, offering a pathway so you can homeownership that was prior to now close to impossible for some Californians. This informative article delves to your just how FHA funds try reshaping the actual house regarding owning a home significantly more open to a wide group.

FHA loans, built to assist low-to-moderate-earnings consumers, offer several advantages which have switched the actual home markets. Away from down credit history standards toward option of a smaller sized down-payment for fha loan, people can also be leverage these financing so you’re able to safe property which may if you don’t end up being out-of-reach. Let’s explore how FHA loans push improvement in California’s casing land.

A special Day and age from inside the Sensible Homeownership

California’s high cost of living, particularly in larger cities eg La, San francisco bay area, and you may North park, has actually postponed of numerous potential home buyers who want to save additional money while making a downpayment than traditional money would anticipate. FHA money keeps extra a different spin to that particular image from the insisting with the an advance payment away from only step 3.5%, much lower than the 20% that all traditional lenders would love. So it down tolerance has furnished market so you’re able to many of people that were just after directed towards the fringes due to not enough capital.

Additionally, FHA finance create credit scores below par, that’s crucial within the Ca because of the stiff field race one to sees consumers which have ideal credit ratings get better product sales. Rather than most other finance, and that require you to definitely afford a get of 620 or higher to help you meet the requirements, FHA loans wanted at least a rating off 580 are eligible for the 3.5% down payment.

To own people that have an entire Element Credit score ranging from 500 and you may 579, the new 10 percent downpayment option is and additionally readily available, expanding cost once more. By the broadening the latest qualification standards to possess mortgages, FHA fund try much more liberalizing homeownership in the Ca, in which property chance has long been a protect of the rich.

Possibilities for the Ca Real estate market

You will find obvious signs and symptoms of the fresh new perception regarding FHA finance to the navigate to the website the true home industry within the California. Not simply provides they desired individuals to buy homes, however they also have prompted business passion within the elements that were in past times dormant just like the house have been too expensive. For example, reduced assessment parts including areas of Main Area otherwise Inland Empire possess filed increased house transformation to people who’re having fun with FHA financial support.

Realtors and manufacturers much more recognize FHA funds as a good reliable and you may viable option, particularly as financing acceptance techniques can be way more versatile than traditional resource. Which have FHA financing, people will safer a mortgage regardless of if the debt-to-earnings ratio exceeds what antique lenders would undertake. It liberty prompts deals which may otherwise slip as a result of due to rigid antique credit requirements.

At exactly the same time, FHA money have experienced a beneficial multiplier impact on California’s economy. Since the significantly more parents was buying home, nevertheless they save money money on domestic assessment, assessment, building work, and you may decorating. This really is involved in the regional discount and advantageous to the economic health from Ca overall. Together with, due to the fact FHA funds try insured by the authorities, lenders try slightly secured, and then make financial costs reasonable.

Challenges and you will Coming Mindset

Once we have experienced, FHA funds possess undoubtedly starred a huge character regarding actual property field into the California, even so they come with its great amount away from difficulties. The initial biggest ailment ‘s the financial top called for out-of any debtor who requires an enthusiastic FHA loan. Instead of plain old financing software where PMI can be removed if the debtor are at a certain amount of guarantee, FHA MIP was lifelong. It continuing expenses can get demoralize some buyers if they have other sourced elements of resource as opposed to the FHA loans.

However, there are such pressures adopting the future of FHA financing in the California: Because of the coming matter away from housing cost, FHA loans are essential to get preferred by first-date homebuyers and you may financially constrained someone. Any upcoming efforts because of the regulators in order to liberalize a mortgage tend to likewise and might suggest advanced conditions to own consumers.

Achievement

For this reason, FHA financing are transforming homeownership when you look at the Ca by removing traps that possess for long experienced place. They have lower down percentage, everyday credit history criteria and you can approval components and by way of them, he’s enabling people to own home and in turn help the discount of the condition. Despite the disadvantages from FHA finance often there is a plus if an individual compares within positives and negatives of the home loan specifically for the very first time people or even the so named very first day homeowners.