Visa Criteria and you will Limits

Additionally, Overseas Investment Opinion Panel (FIRB) approval becomes necessary to own low-long lasting people purchasing assets in australia. To 80% of one’s price is going to be lent, with a great 20% deposit together with costs necessary.

Protecting in initial deposit with a minimum of 20% along with 5% to cover extra expenses like stamp responsibility, which have someone functioning complete-big date, having an optimistic credit score around australia, and you can showing sound savings techniques when you find yourself reading is to assist in improving this new odds of financial approval.

Parental Recommendations and Guarantors

An effective guarantor is somebody who undertakes to imagine responsibility for that loan when your borrower is unable to satisfy their repayment financial obligation. Having a good guarantor (always a daddy) can also be improve the probability of mortgage acceptance and relieve the quantity of put you’ll need for in the world people.

The needs for having a great guarantor may differ depending on the lender, but essentially, they should has actually an optimistic credit rating, a professional source of income, and you can own a home. The procedure having acquiring a guarantor generally necessitates the guarantor in order to indication financing contract and gives proof earnings and you may borrowing from the bank record.

Promoting Your chances of Loan Acceptance

To increase the probability of loan acceptance, it is very important keeps an excellent credit rating, demonstrate genuine deals, maintain a steady income, and relieve present personal bills. On the other hand, you will need to submit an application for the ideal matter and comment the eligibility requirements.

Maintaining a good credit score is important getting financing acceptance because the it indicates to lenders that you are an established borrower and you can can be respected in order to satisfy the mortgage fees.

Building a great Credit score

A credit rating of 661 otherwise 690, depending on the score’s range of step one,2 hundred or step 1,000, is recognized as an effective credit score. Creating which rating involves and make timely payments, keeping a reduced payday loan companies in River Falls borrowing utilization ratio, and achieving an extended credit history.

Maintaining an optimistic credit history is useful as it can potentially be considered one to for much more favorable financing conditions and interest rates, hence exhibiting economic obligation.

Preserving to possess in initial deposit

Preserving for in initial deposit is crucial for financing recognition because it implies to help you lenders that you possess the called for financial resources so you’re able to fulfill the loan repayments. In initial deposit from ranging from 20% and you can 30% of the overall loan amount, having an extra 5% necessary for get can cost you, is typically needed for scholar mortgage brokers.

Whenever preserving upwards towards deposit, you could seeking the least expensive scholar accommodation for the Brisbane or whichever city you are residing to slice down costs.

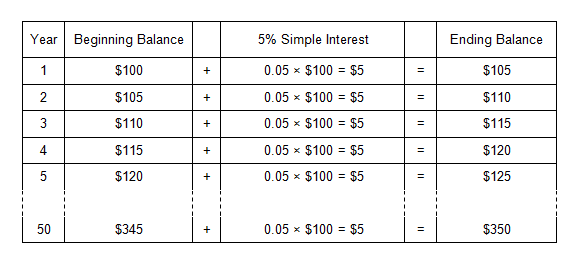

Ideal approach to preserving for in initial deposit should be to describe a goal amount, monitor expenses, present a feasible finances, select a bank account that have an aggressive rate of interest, and you may introduce automatic offers.

Demonstrating Regular Money

Constant money refers to a typical and legitimate source of income that can be used to demonstrate monetary balance. That have someone otherwise steady income can increase the possibilities of mortgage recognition due to the fact lenders account for domestic money whenever examining an application. This will make it easier for a couple of individuals to get accepted, particularly when one has a regular full-date earnings.

Keeping an established income, providing pay stubs otherwise tax returns, and you will exhibiting a robust deals records are the best strategies for showing consistent income.

Navigating your house Financing Processes

The house financing techniques involves several actions, beginning with pre-recognition, followed by software, underwriting, and eventually closing. So you can initiate, applicants need certainly to get an effective conditional pre-recognition, after that discover property and implement for a home loan.