USDA fund introduce a unique method getting eligible men and women to see its dreams of homeownership during the Maryland’s outlying and suburban regions.

Whether you are a primary-day customer or trying change so you’re able to a bigger property, an effective USDA mortgage now offers good terminology making their hopes and dreams a great reality. Companion which have Griffin Money to get into competitive rates and expert information each step of your means, guaranteeing you seize a full prospective of the indispensable chance of homeownership during the Maryland.

What’s a good USDA Financing?

A great USDA financing , officially referred to as USDA Outlying Invention Guaranteed Casing Financing Program, is actually a mortgage loan system offered by the usa Company from Farming (USDA). It aims to assist anyone and you may family inside the to get home from inside loan places Gales Ferry the rural and suburban portion which have beneficial words. Qualification is founded on assets venue and you will borrower earnings, with benefits as well as no down payment and competitive interest levels. These finance are protected from the USDA, having income restrictions and you may assets conditions to make certain safety and habitability.

Full, USDA finance render a low income home loan choice for some one and you can family members looking to buy land in the designated rural and you can suburban section. They offer positives like no down payment, low interest, and you may backing regarding the USDA, making homeownership a lot more doable for those who may well not be eligible for conventional funds.

USDA Mortgage Criteria in the Maryland

For the ent money has actually certain requirements one individuals have to satisfy to be eligible for such home loan. Here you will find the general USDA loan criteria during the Maryland:

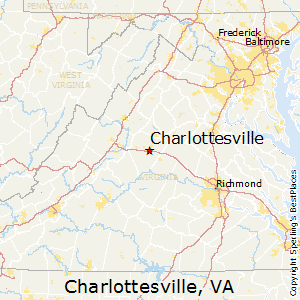

- Property Qualification : The house becoming financed need to be located in a selected outlying area or an eligible residential district urban area based on USDA guidance. Individuals are able to use this new USDA’s on the internet map equipment to test the latest qualifications out of a particular assets.

- Income Qualifications : USDA finance possess earnings limitations according to the area’s average earnings. Borrowers must make sure that its domestic income doesn’t meet or exceed such constraints so you’re able to qualify for a USDA financing. Earnings limitations are very different with respect to the number of people throughout the household and county the spot where the house is discover.

- You.S. Citizenship or Permanent Residency : Consumers have to be U.S. owners, non-resident nationals, or accredited aliens which have legitimate abode in the usa.

- Credit score : If you find yourself USDA financing routinely have more versatile borrowing requirements compared to old-fashioned finance, individuals are susceptible to borrowing from the bank testing. A minimum credit score may be needed because of the financial, although this can differ.

- Debt-to-Income (DTI) Ratio : Loan providers commonly assess borrowers’ personal debt-to-earnings proportion, the percentage of disgusting monthly money one to goes to spending debts. When you find yourself there is no rigorous restrict DTI needs place by USDA, lenders commonly favor consumers with a beneficial DTI out-of 41% otherwise lower.

- Stable Income and you can Work : Individuals must have a steady income source and you will employment. Lenders typically wanted at least two years out of constant a position records.

- Power to Afford Payment : Individuals must demonstrated their ability to cover the latest month-to-month mortgage repayments, possessions taxes, insurance policies, or other houses-related costs.

Conference these types of financial-certain standards, as well as USDA qualifications standards, is important to possess individuals seeking a USDA financing, whether they want to buy a preexisting assets or make an application for good USDA design mortgage inside the Maryland. However some flexibility is present, consumers is to endeavor to bolster their monetary reputation to improve its possibility of recognition and you may safer favorable financing terminology.

Advantages and disadvantages off USDA Funds

Within this phase, we’re going to explore the pros and downsides out-of a great USDA financing to money your house pick. By the examining the advantages and you will potential drawbacks, you’ll be able to get an extensive understanding of whether or not good USDA rural innovation financing in the Maryland aligns together with your homeownership requires.

- Zero deposit : One of several advantages of USDA finance is the fact they often times require no down-payment, and make homeownership way more accessible of these which have restricted coupons.

- Low interest : USDA fund usually provide competitive interest levels than the antique mortgage loans, helping consumers reduce attention along side lifetime of new financing.