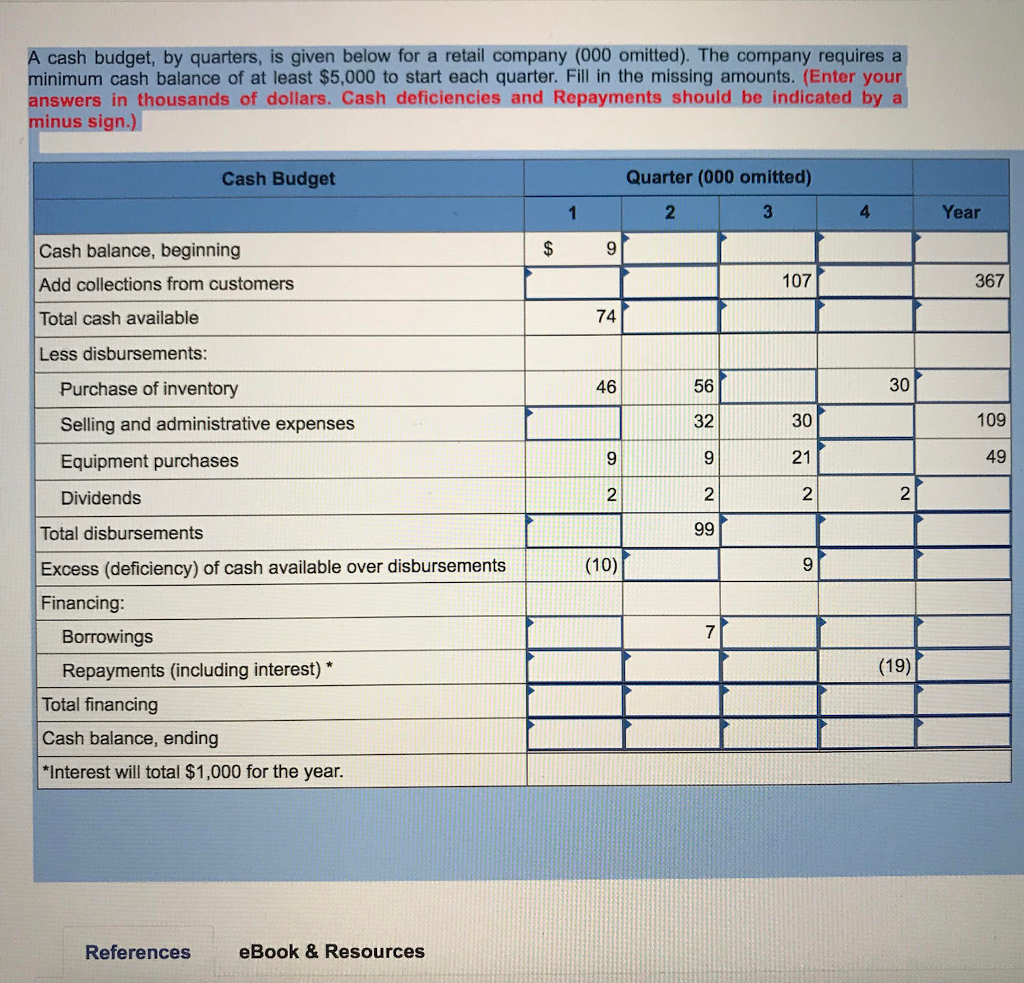

** New monthly obligations revealed here dont tend to be most charge for example just like the homeowners insurance, property taxation, otherwise PMI with the antique fund. Costs was such as motives simply. Perhaps not according to currently available costs.

A huge deposit as well as promises a lesser rate of interest. That’s because when you spend far more upfront, the borrowed funds financier considers your a reduced-risk borrower.

Thank goodness, this new down payment can not only come from the savings. Down payment current cards now make it easier to buy your dream household at all the way down prices. Financial financiers enables bucks gift ideas of family and friends people to assist reduce their payment per month.

not, prior to playing with gift bucks, make sure you document the current properly to cease rejection of the the financial institution. You should create a proper current letter stating extent, the new donor’s information, and you can a letter certifying that the gift isnt that loan inside the disguise.

Particular loan software that allow current finance getting a down payment become antique financing, USDA loans, Virtual assistant funds, FHA finance, and you may jumbo finance.

Financial obligation to help you Income Ratio

As previously mentioned, lenders study your debt-to-money ratio whenever applying for a loan. Based on the DTI, they may be able determine how most of your monthly earnings visits expenses and how far you can easily place to the your loan repayment.

Sound right their minimum monthly installments for your mastercard repayments, car and truck loans, figuratively speaking, unsecured loans, and any other expenses (Never become the utility payments, searching bill, otherwise book.)

- That is the DTI.

Instance, a person who earns $5,000 thirty days and you will pays $2,000 30 days for the costs provides a good DTI of forty%.

DTI establishes their eligibility for a financial loan system. A normal mortgage needs a great DTI not surpassing forty-five%, whereas FHA funds wanted a beneficial DTI from 50% or even more. Although not, typically, an effective DTI surpassing 43% minimises your probability of getting home financing.

Cost Period

Their mortgage loan’s fees period refers to the lifetime their financier set on how best to obvious new loanmon repayment attacks include 29, twenty-five, 20, fifteen, and you can a decade.

*** The new monthly payments shown here do not tend to be additional charges for example as homeowners insurance, More hints assets taxation, or PMI into the antique loans. Costs try such as for instance to have intentions only. Perhaps not according to on the market costs.

On the description, a longer financing installment lowers the new monthly payment, for this reason letting you match a very pricey household into your month-to-month finances.

But not, going the actual loans more three decades setting possible pay a lot more notice. Furthermore, a shorter fees period boasts down interest rates. For this reason, you might save your self more on the interest pricing.

It’s also possible to opt to start with a lengthier payment period and you may change to a smaller-identity since your money increases. It is possible to only pay the fresh settlement costs on the the fresh terms and conditions so you can make sure the the latest payment is sensible.

Interest rate

What kind of cash you have to pay yearly is actually expressed just like the a percentage of dominating matter. Such as for instance, a beneficial $100,000 mortgage attracts a destination away from $cuatro,000 annually at a rate regarding 4%.

Your mortgage’s rate of interest can impact just how much house you could potentially manage. Even when the domestic has a top rates, less interest usually interest a reduced monthly payment. At exactly the same time, the low the pace, the greater number of affordable the loan.

Once more, we glance at the $three hundred,000 home with a great 5% deposit and a 30-year financing name. We should look at the end result of interest costs on the cost of your house. Each row stands for an effective fifty% rise in the interest rate: