Subprime mortgages are only suggested given that a short-term solution through to the borrower advances their borrowing and certainly will qualify for a regular financial. Such as, the common subprime mortgage identity selections away from 6 months to help you 24 weeks. Just like the average subprime home loan speed try six.5% in order to 15%, you would not want to spend which rate of interest to have very long!

Yet not, we located themselves stuck throughout these high-desire fund in the united states in the early 2000’s, and if the brand new property , these people were kept under water on the mortgages. This is referred to as subprime home loan drama. Are under water into a mortgage means that you borrowed regarding their financial compared to the residence is in fact value. So it triggered a revolution off property foreclosure and additional imbalance into the the newest housing marketplace.

Loan providers from inside the Canada and particularly the united states enjoys because the tightened up up their criteria for providing subprime mortgages, but you can still find some people just who can benefit out of this style of mortgage. If you are considering a good subprime home loan, make sure you comprehend the threats with it.

Kind of Subprime Home loan Individuals

When you find yourself subprime mortgage loans usually are an option lending company out of prerequisite for these refuted home financing during the a lender, there are many different almost every other fool around with times in their eyes. This includes whoever has a past bankruptcy otherwise individual suggestion, when you’re recently thinking-functioning, when you have unconventional income sources, or a high loans-to-income ratio. The fresh section below takes a glance at the services off prominent subprime financial borrowers for the Canada.

If you have got a current case of bankruptcy or user offer when you look at the for the past, it might be burdensome for one to be eligible for a home loan at a financial otherwise credit partnership. However, you may still be able to be eligible for a subprime financial.

According to subprime mortgage lender, they might need that your case of bankruptcy otherwise individual offer getting released for around 12 months just before considering your for a financial loan. It requirements can be as little while the 3 months or quicker immediately following becoming discharged away from personal bankruptcy. On top of that, conventional loan providers, such as for example banking companies, may require a minimum of 24 months to successfully pass ahead of becoming capable be eligible for a primary financial.

For Notice-Working Consumers

While many banking companies give care about-functioning mortgages, they frequently need you to was basically care about-operating that have proof of earnings for at least two years. This might be with the intention that your earnings was regular and certainly will be employed to pay your own real estate loan.

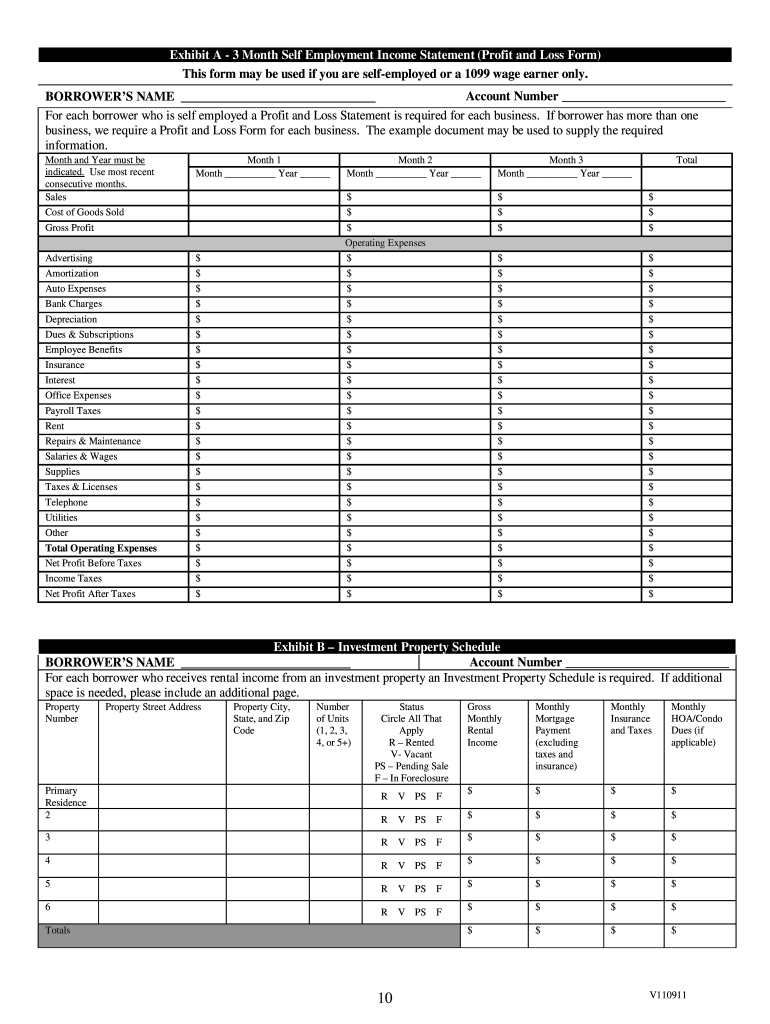

If you have has just become a business or turned notice-used in less than 2 years, you could potentially need a good subprime financial out-of an exclusive bank or B lender. Specific lenders may not actually guarantee oneself-work earnings to have a great subprime mortgage! It is labeled as a reported earnings mortgage, that’s legal from inside the Canada. Compared, mentioned money mortgage loans was unlawful in the usa.

Getting Consumers having Bizarre Money Supplies

Unconventional money present, for example individuals you to rely on commission money, financial support income, or self-employed earnings, possess challenge acquiring a home loan. This is because this type of income present is volatile or vary regarding 12 months-to-seasons. Similar to self-working consumers, a reported earnings financial or no income verification mortgage will help individuals with unusual otherwise bizarre money.

To have Consumers with high Debt-to-Income Ratio

Lenders make use of your personal debt-to-income (DTI) proportion so you’re able to determine whether or not you qualify for that loan according to your existing obligations stream. Additionally, http://paydayloancolorado.net/englewood/ it contributes to how much cash it is possible to acquire.

DTI try determined of the separating your total month-to-month debts by the gross month-to-month earnings. Loan providers typically like to see a great DTI off 36% or shorter, many could go all the way to forty-two%, the greatest desired because of the CMHC to have insured mortgages. Should your DTI is actually high, you do not have the ability to be eligible for an everyday mortgage anyway. Even although you carry out, your ount than simply you if not would-have-been able to.