- To determine when the a great fixer-upper is the correct investment for your requirements, carry out a strategy for how possible upgrade the home. This will enables you to examine they to many other qualities you’ve viewed to see and that house is most appropriate to you.

- After you have written your plan, it is important to know if its possible. It indicates talking to the newest property’s condo otherwise co-op board, or if perhaps the home is freestanding, the latest Department from Structures Borough Office.

- Carefully lookup and you may interviews benefits who possess completed comparable plans and create a funds into the recovery.

Buying property when you look at the New york city is a huge decision, specially when you reason for choosing between a good fixer-higher and you may a move-within the in a position otherwise brand new-design family. If you have been considering a great fixer-top – which usually function a-14 equipment property, condo, co-op or brownstone which is wanting particular TLC – here you will find the most readily useful inquiries you need to be familiar with prior to taking this new dive.

Have an idea in your mind

The initial step so you’re able to determining in the event the a particular fixer-top is an excellent complement is to try to build a definite attention out-of how you will wish increase the property. This will make it more straightforward to choose which inquiries you need certainly to query in order to know if the home is actually value to buy. As well as, should you move forward, it will help you put a framework in position towards the renovations.

If at all possible, you’ll be able to developed this type of preparations because you look at the properties through your showings. That being said, keep in mind that not all home improvements are manufactured equivalent. The plan for you to property get include to make reduced makeup reputation, when you find yourself your arrange for several other can include performing an abdomen renovation.

When you are you’ll be able to ultimately have to determine how large out-of a renovation you are willing to undertake, it’s best to look at every indicating as the a flush record. Think of their plan for for each and every assets as being independent out of the rest. Upcoming be honest having on your own on whether or not you happen to be able to out of dealing with range ones created renovations.

Enquire about building restrictions to the renovations

The next thing doing try know if your eyesight try possible. In the New york, which usually means confirming perhaps the building lets your created home improvements. Keep in mind that per condominium and you will co-op panel possesses its own number of rules and regulations. There’s a chance that you’ll require for recognition out of the new panel before you make any results or this may not enable it to be certain home improvements getting complete anyway. Make sure to inquire what is let and just how the method work one which just fill in a deal.

When you are searching for an effective freestanding household, you will possibly not provides a condo otherwise co-op panel in order to compete with, however, that doesn’t mean you will be completely without statutes. In this situation, your job should be to decide which it allows are essential to-do work and just how that processes qualities. To achieve this, you ought to see your Department regarding Structures (DOB) Borough Place of work.

Do a little monetary browse and you can interview positives

Now you must when deciding to take a close look from the just how much functions their renovations will include and you may what they will definitely cost. I encourage contacting a talented contractor and you can architect to possess let. Make sure you look for experts who have completed similar ideas prior to. Following, once you have a few planned, do your homework because of the seeing its past plans and you will asking for studies away from early in the day clients.

In addition to delivering professional viewpoints, it’s important to analysis individual lookup. You’ll want to think such as for example an investor and take a look at the prospective profits on return (ROI) toward property. As techniques, we suggest adopting the one percent rule, and that claims you to definitely property must have the ability to rent for 1% (or more) of the complete initial cost in order to be experienced an effective smart buy.

Shortly after accounting toward cost of buying the property, you’ll want to budget for people home improvements you intend to deal with. There was a bit more latitude as to what fast and easy online payday loans we offer to blow, based on how trendy you would like the past equipment to get. Such as for example, predicated on Remodeling’s 2022 Prices against. Well worth Statement, your bathroom redesign having midrange provides will run you $27,164, typically. Having luxury has actually, that figure can move up so you can $82,882.

Ultimately, a good thing you can do to set up you to ultimately tackle a great fixer-upper is to try to get ready for new unforeseen. This can be trick in terms of putting together one another your budget as well as your schedule. Economically, you’ll want to hop out at the least an excellent ten% support on your own budget for overages. Time-wise, you will need to include a few even more days so you’re able to take into account waiting to the it allows and you will last approvals along with the time it needs to do the work.

Get money in order

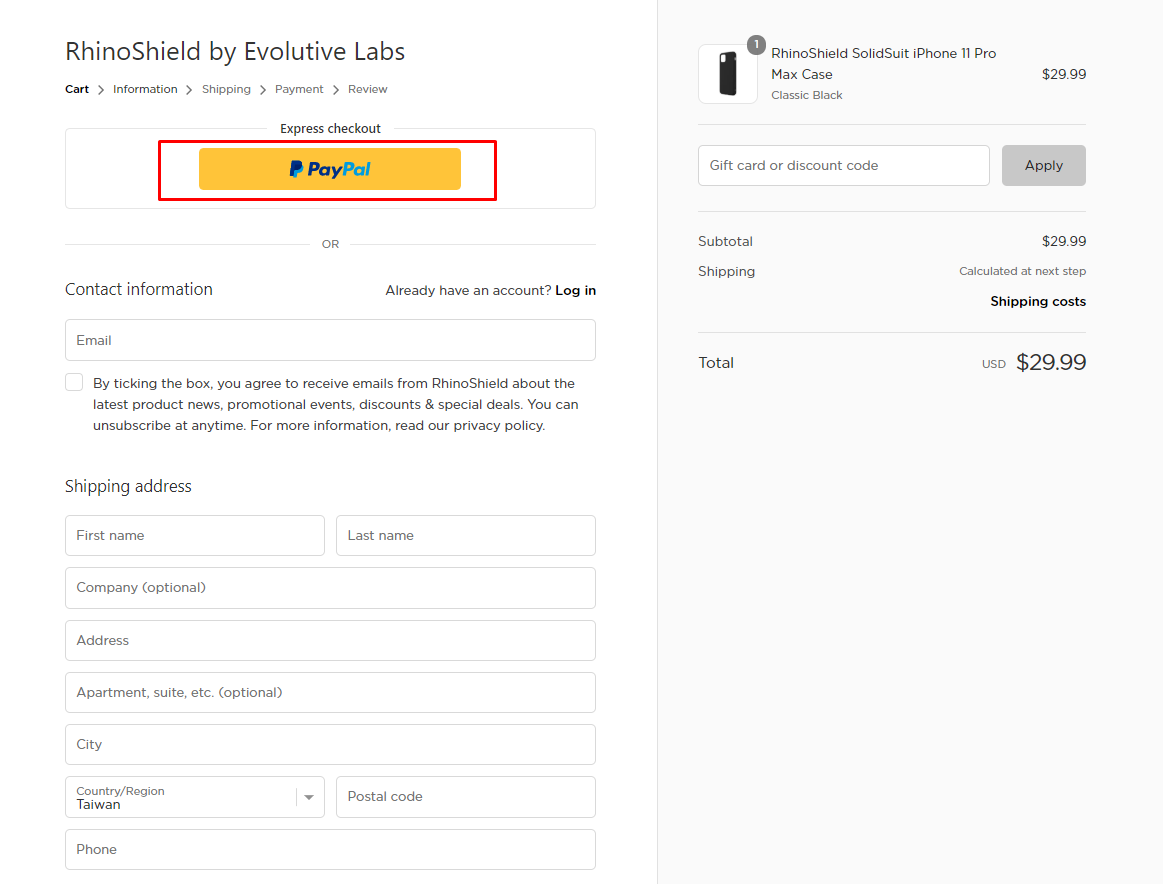

Once you decide that the property you’re interested in are an audio funding, the past action before submitting a deal is to obtain their cash manageable. In this instance, when you meet with your financial to track down an excellent preapproval or prequalification, you really need to inform them that you will be especially trying to find taking an all-in-You to definitely Framework Financing.

While the term means, All-in-One Build Fund make boosting a home much easier while they will let you move the expense of the fresh reount you might be credit inside home financing. Although not, in return for the additional financial support, these fund will come with their selection of qualifying criteria and you will rates of interest.

Gather a professional class

All informed, to get a good fixer-higher can be hugely rewarding, offered you happen to be prepared to take on work. While unsure in the bringing the diving, comment these tips to buying a beneficial fixer-top within the New york.

At first Republic Financial, i concentrate on book financial support ventures and you can functions directly having genuine home positives as well as their subscribers to assist them to learn their recovery mortgage solutions. Learn more right here or keep in touch with a first Republic banker now.