That have a clean credit slate can be an issue. And no credit score lenders don’t have any facts to go on, but the Financial Hut might help find out how to rating a no credit history financial now.

- Expert Articles

- Bad credit Mortgage loans

All of us have to begin with somewhere, in fact it is never ever so much more genuine than along with your credit score. When you yourself have recently turned into 18 next banks or any other lenders anticipate that haven’t any credit score to enable them to glance at, but once their middle-twenties have rolling to the prior, having less a clear economic records may start to appear skeptical. It’s sufficient that particular lenders and standard banking institutions eradicate a keen absence of credit history worse than simply a merely poor record!

Fortunately, at Financial Hut, we run a variety of lenders that an effective much more realistic consequently they are ready to consider other factors combined with your credit score to help you make a good fair character when creating a credit choice. We are able to help you get a no credit history financial and you can to show your current hidden reputation to the a study you can feel pleased with.

Reasons why you may have no credit history

Into the a scene in which it-all are submitted and held, you could think unusual that somebody is located at a posture in which they are a grownup no statement of finance, however, there are lots of legitimate grounds that may happen, instance:

Right at the top record try those who nonetheless live with its mothers. We understand how difficult its to obtain on the assets ladder in the current environment and you can making home at the 18 is not the sure issue it once was.

The new financial crisis out-of 2008 had a big impression within this area, and you may statistics show that when you find yourself somewhat lower than 20% out-of young adults old 20 so you’re able to 34 remained life from the household into the 2008, by the 2015 it had mounted so you can more 25 %.

When you have invested all your valuable lives life style at your home, you may not have debts in your title, you have never paid back rent and you could even have gone versus a bank checking account. It-all adds up to make you undetectable so you can borrowing source providers.

If or not the as the you’ve lived overseas for the majority decades and you will recently come back, or if you is actually a different national and only undertaking your own lifetime in the united states, with has just arrive at the united kingdom is another perfect reasoning you will be missing a credit history.

Credit info only keep the past half dozen years of deals to your file. Numerous the elderly, in their fifties and you will past, can easily invest half a dozen many years instead of and work out a mark. Gladly getting towards the that have existence without needing a credit credit otherwise bank account is also set you on the tincture!

It is currently an appropriate criteria to take the fresh new electoral move but for years one wasn’t possible. Lots of people haven’t trapped toward system and it’s really a core piece of studies getting credit recording that makes you tough to realize when it’s shed.

- No long lasting or repaired British address

- No work records in britain

- Via a refreshing history and never in past times wanting credit

- Recently put out out of jail

- No Uk family savings

Ways to get a mortgage without credit rating

If you aren’t to your electoral move after that taking a great home loan are close impossible, making it crucial that you start truth be told there. After you a properly entered, a lender could well be willing to look at your products in order to understand this it is youre otherwise rather than a credit history. Even though hosts can be used often to support the selection while making, there is nothing black-and-white and a keen explanatory talk can go quite a distance so you can to make trouble in this way little more than a small hit inside the the road.

During the Mortgage Hut we specialize in enabling our consumers to help you the best lenders, to make you to meets which means you have the best price it is possible to which comes with picking out the lenders that can provide the fresh new no credit score home loan you prefer!

Just counting on aside specialist help and you may a casual financial isn’t really sufficient no matter if you will want to quickly begin carrying out anything you can be to cultivate an optimistic credit report. Required as low as 90 days commit away from an empty file to help you an exciting one to, whilst you need to use specific care and attention here also.

Strengthening your credit report properly

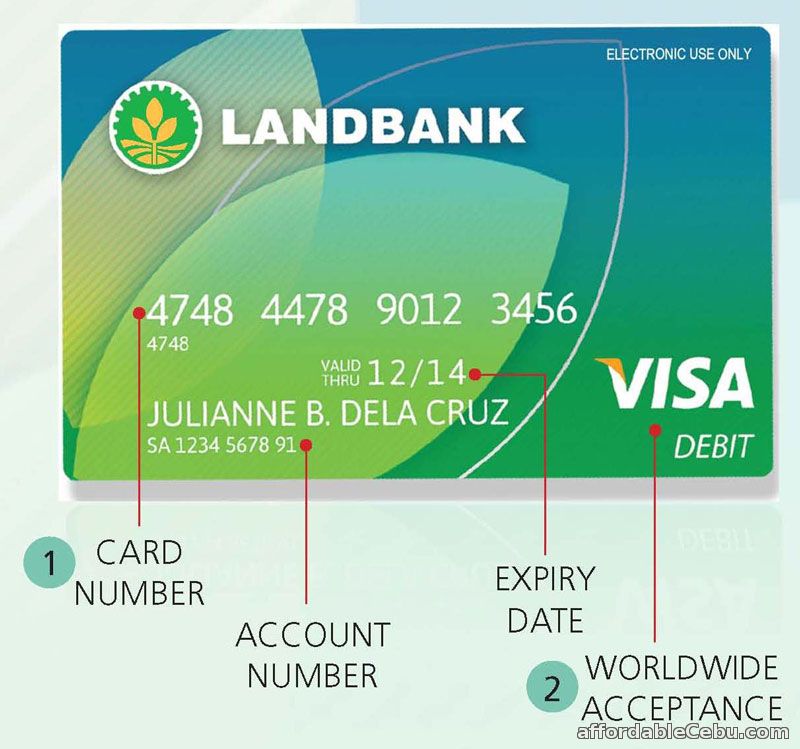

Trying to get credit and and make typical repayments to demonstrate youre a good borrower ‘s the loans Hamilton foundation to build a credit history. When you get an elementary bank card, a bank overdraft, power bills in your identity and you will a straightforward portable deal, then inside two months their in control accessibility those people contours out-of borrowing will probably look wonderful so you can a lending company – yet not, do not your investment feeling out of making an application for borrowing on the rating itself!

When you apply for the fresh new borrowing from the bank, its taken into consideration. Do so too often and you will as well irresponsibly also it can begin to seem including frustration and you may concerns for example how come this individual you would like much credit so fast?’ start to set second thoughts on the sight of one’s loan providers. While refuted having borrowing from the bank, don’t immediately apply for alot more, but step back and you can allow the dirt accept.

Perseverance is key and you can realize that to produce good doing score simply take kid tips obviously, you’ll be able to make use of this time for you to cut back their put, putting you into the a healthier condition to own a home loan and getting some other a mark-on your credit score.

Will i you would like a larger put easily don’t have any borrowing number?

A larger put constantly assists their lending application, but zero, never have to be worrying significantly concerning the deposit. Dumps anywhere between ten% and you may 20% are definitely the regular level to possess a domestic home loan, therefore bundle with this thought and you can speak with all of our advisors observe just what business are around for your.