Exactly how much Boaz loans places home loan attract is actually tax-deductible?

The official type of the latest Canadian authorities is that you could deduct the eye you have to pay into the any cash you use so you’re able to pick otherwise boost a rental assets. If you rent your home for the whole seasons, then overall level of interest in your mortgage is taxation deductible. For those who simply book it to possess part of the seasons, upcoming only the period (age.g. 4 months) interesting costs are tax-deductible.

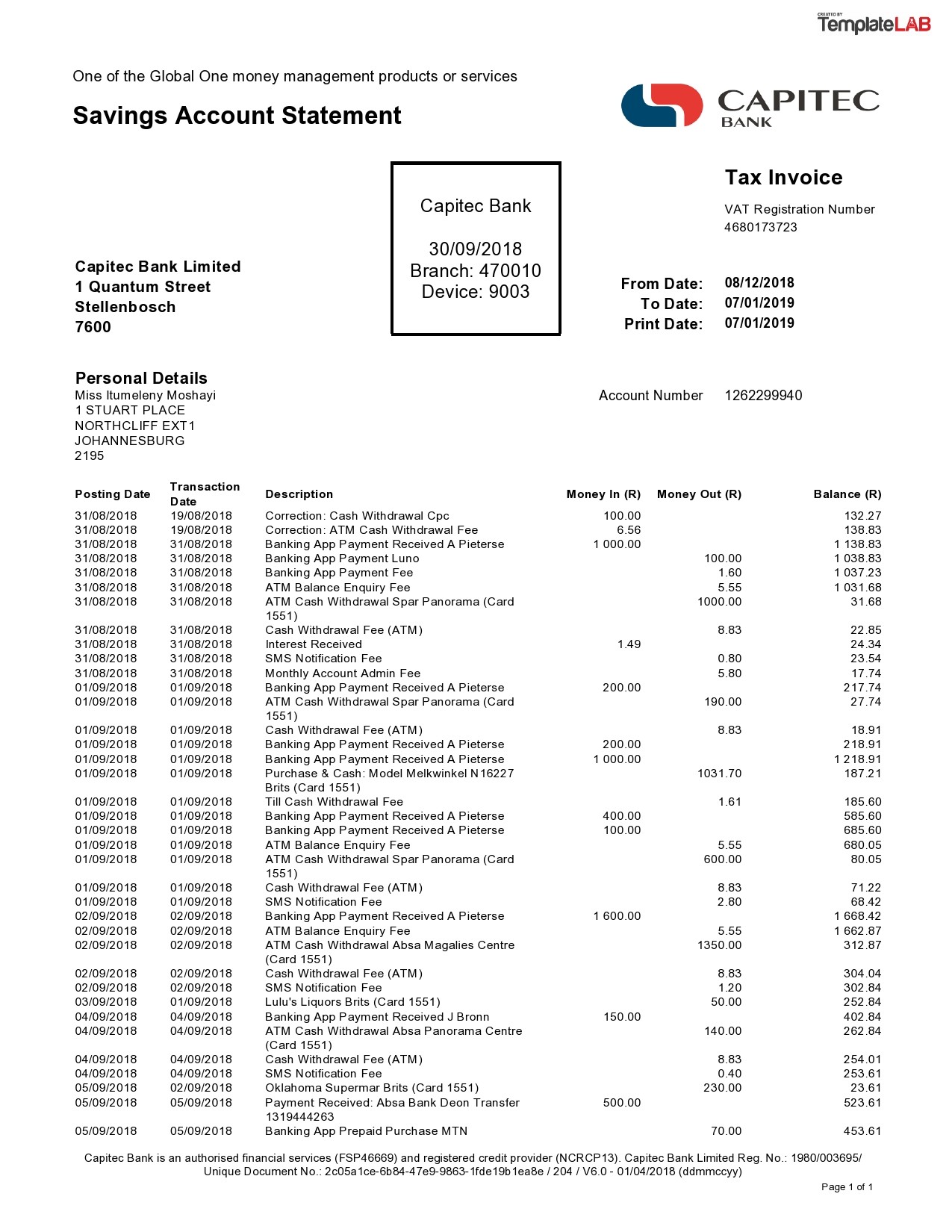

It at some point utilizes both ratio of the area leased aside, plus the period of time told you area is actually generating local rental income. Here’s a table to help break it off for you:

Just like the a last mention, with regards to the bodies regarding Canada, you simply can’t subtract entirely any swelling-share amount paid in attention. Alternatively, you’ll prorate extent for the rest of the definition of of one’s financial otherwise mortgage. To phrase it differently, you dispersed the total amount you paid-in demand for you to year over the course of the remainder of your mortgage identity.

In times your local area staying away from the property area generate leasing earnings, check out our very own post, What is the Smith Operate, more resources for how much cash of mortgage notice you can expect to be income tax-allowable.

Try mortgage attract income tax-deductible for rental money?

Sure. People mortgage focus repayments on your property is actually income tax-deductible in line with the proportion out-of room, and period of time that area was used to help you create rental money.

Is it possible you discount home loan attention whenever a home based job?

In the event your home is much of your bar or nightclub, or if you explore a certain room in your home entirely getting team objectives (such as a private health spa otherwise an accounting place of work), you can subtract home loan desire but simply around the amount of space put monthly (understand the desk more than). Imagine if you went a great laser hair removal providers in your basement, and only made use of the basement for that purpose. Should your basement was 20% of the complete rectangular video footage of your property and you also went your organization complete-returning to an entire year, you can reclaim around 20% of the full home loan notice costs, based on how many days every month you had been using the place to suit your needs.

Note: that it merely is applicable once you work at a business from your home. While you are employed by a manager and home based, mortgage attention is not taxation-allowable.

For individuals who promote your residence after you’ve earned earnings off your house, possibly by using it as a residential property, or regarding running your organization, there can be something you should bear in mind: financial support progress tax. Money progress was an income tax you have to pay toward winnings one your property has created since it come creating earnings. That it only applies for people who turned into most of your quarters to your a keen money spent, however, if you do sell your property, you’ve kept to disclose the fresh marketing to your CRA, no matter whether your utilized your residence as the a residential property or perhaps not.

Conclusion

Sooner, making sure you are on just the right side of the rules whenever creating regarding people costs getting tax motives is key. While you are we endeavored to deliver many appropriate suggestions you are able to to your if or not financial focus was income tax-allowable, definitely talk to legal counsel in advance of investing dismiss many costs. Make sure that your know your position, eg just how you’ll be by using the possessions your financial try purchasing to have, that will establish just how much of focus is actually tax-allowable. Essentially, home loan notice is only income tax-allowable whenever you are launching income of renting your house, or regarding powering a business. To learn more about how you can generally disregard your home loan interest for a solely residential property, here are a few our post on The Smith Operate, or talk to an effective nesto advisor.